Portmone API Gateway for Partners with PCI DSS level

Glossary

| Term | Definition |

|---|---|

| Merchant, Partner | Organisation which has signed a payment acceptance agreement with Portmone.com |

| Client, Customer | A person who visits the Merchant's web site in order to learn about the range of goods (services) and to make a purchase |

| Card, Payment Card | Payment cards of Visa, Mastercard international card associations and the National payment system PROSTIR |

| Authorization | The process of giving access rights or other powers to the Customer, program or process |

| Recurring Payments | Automatic payments (no participation of the client and re-entering card details required), which are carried out with the consent of the client |

| Token | A unique digital identifier of a card, which is generated during the first operation and then used for quick payment. Token can only be used to repeat a similar transaction as at the first payment |

| SHOPBILLID | A unique identifier (Id) assigned to every transaction (payment document) in the Portmone.com system |

| CVV2/CVC2 | CVV2 (Card Verification Value 2) is a three-digit card security code that helps verify legitimacy of a Visa payment card. The Mastercard payment system has similar card security code called CVC2 (Card Validation Code 2) |

| Acquiring Bank (Acquirer) | A bank that organizes banking cards acceptance points (terminals, ATM’s) and processes full range of financial operations connected with performing bank settlements and payments by banking cards at that points |

| Issuing Bank (Issuer) | A bank licensed as a member of a card association (like Visa or Mastercard), that issues and maintains payment cards |

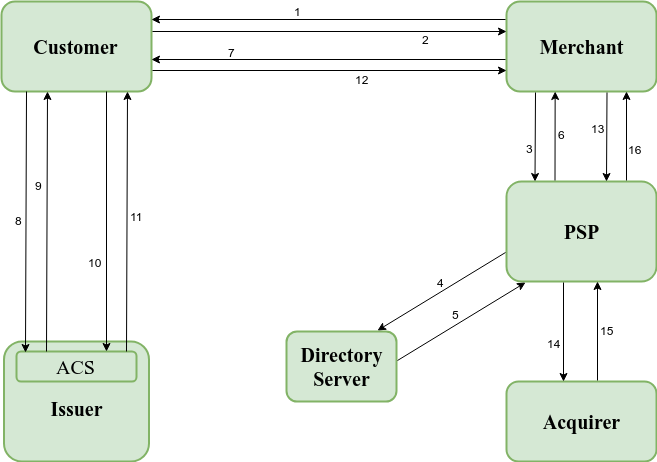

| 3-D Secure | 3-D Secure is a protocol which used to secure handling of online bank card payments |

| PSP | PSP (Payment Service Provider) is a company that provides merchants with online services for accepting electronic payments by various payment methods. For this document this term refers to Portmone.com company |

| ACS | ACS (Access Control Server) is a tool used by card issuing banks to cardholder authentication (allow customers to verify their identity and offer a more secure transaction to the online merchants) |

| Client-Side Encryption (CSE) | Client-side encryption is a data protection technique in which information is encrypted on the Client's side using PSP provided Public key before being transmitted to a Merchant’s server. Encrypted data can’t be decrypted on Merchant’s side |

| IPS | International Payment System |

1. Introduction

Portmone Gateway API based on transparent type of integration with "Client-Side Encryption" (CSE) solution. CSE allows to reduce PCI DSS burden for merchant.

Cardholder data is encrypted on client side, so it cannot be read, and then passed to Portmone host. To decrypt the message from merchant’s side the unique client key is used.

Type of communication: host-to-host.

Type of protocol: HTTPS.

Type of messages to exchange the information: XML-messages or JSON notifications.

2. Preconditions

To get started with the API, you need:

- to have a PCI DSS certificate;

- apply for registration in the Portmone.com system;

- provide the URL-address for notifications (URL which will be used by Portmone.com system to send XML-messages by POST method via

dataparameter or notification in JSON format); - to append the rsa-co.min.js script on the payment page to use CSE solution.

The next parameters will be provided to the Merchant by Portmone.com after registration:

- payee id;

- login;

- password.

Endpoints

For payment by card or by token the following endpoint is used: https://www.portmone.com.ua/r3/pm/.

Endpoint for requests after the 3DS authorization: https://www.portmone.com.ua/r3/pm-mpi/.

2.1. Card data

To encrypt card data use rsa-co.min.js script. Methods of rsa-co.min.js should be called from PM object.

This script contained next methods:

PM.setPublicKey(publicKey) – sets the value of the public key;

PM.encrypt(cardData) – returns an object with encrypted bank card data;

cardData – object with necessary fields that describe card data, like:

{

"cardNumber":"4444333322221111",

"mm":"03",

"yy":"20",

"cvv2":"111"

}

<script type="text/javascript"

src="https://www.portmone.com.ua/r3/resources/services/js/lib/rsa-co.min.js">

</script>

<script type="text/javascript">

(function() {

PM.setPublicKey('key_value');

function encryptMyData() {

var postData = {};

var cardData = {

cardNumber : cardNumber,

mm : mm,

yy : yy,

cvv2 : cvv2

};

postData['encrypted-data'] = PM.encrypt(cardData);

// AJAX call or different handling of the post data.

}

})();

</script>

2.2. Signature

The rule to create a value for the signature field (example for PHP):

$login = 'wdishop';

$payeeId = '1185';

$password = 'wdi451';

$shopOrderNumber = 'test123';

$billAmount='150';

$key = 'BDFC166F8AE2F5323A557DB6CA16758D';

$dt = date("YmdHis");

$strToSignature = $payeeId.$dt.bin2hex($shopOrderNumber).$billAmount;

$strToSignature = strtoupper($strToSignature).strtoupper(bin2hex($login));

$signature = strtoupper(hash_hmac('sha256', $strToSignature, $key));

The set of fields to create a

signaturemay vary for different methods. In case of differences from the example above, the set of fields involved in thesignaturegeneration will be given directly in the description of the method.

2.3. Asynchronous mode

In case when you are using parameter mode which set in 1111 value in your payment request, you will receive data with format and structure as follows on your notification URL:

Successful response:

{

"transactionId": "419344443",

"attemptId": "9m304ghzzl0k8c4cko08soww0sokcws",

"errorCode": "0",

"error": ""

}

Parameters description:

| Parameter | Description |

|---|---|

| transactionId | ID of the transaction in the Portmone.com system |

| attemptId | Request id which initiate payment by card. Randomly generated value, length 31 character (for example, 3wlk66m64q0wokcgkwog4040osw04ks) |

| errorCode | Error code (0 if payment was successful) |

| error | Error description |

Then, if error not occurred, on URL for the notifications will come the request with structure described in section 9.3 “Notification in JSON format”.

3. Payment methods

3.1. Payment by card

3.1.1. Create new payment

Description:

To make a payment you should send a request to the following URL: https://www.portmone.com.ua/r3/pm/.

Availability and restrictions:

Portmone.com doesn’t support cross-origin requests (CORS requests). It means that request should be sent from your server only.

Request structure:

Please, refer to "3.1.1 Payment by card request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| paymentType | Must be set "card" value | Yes |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system | Yes |

| shopOrderNumber | Number of paid order in the Partner’s system | No |

| billAmount | Amount of the payment | Yes |

| emailAddress | Email address of the payer | No |

| shopSiteId | Digital identifier of a sales channel | No |

| billCurrency | Currency of the payment. Default value: UAH | No |

| description | Payment description (comment to the order/ payment details) | Yes |

| token | Set empty value | No |

| cardData | Encrypted value of payment card data (card number, expiration month, expiration year, CVV2) | Yes |

| preauthFlag | Payment pre-authorization flag (value "Y" indicates that this payment is carried out using the pre-authorization procedure (see section 5 "Reject/Confirm preauth payment"), value "N" is a regular payment without pre-authorization. The default is "N") | No |

| cvvVerifyFlag | The default is "Y", set "N" for payments without CVV2 | No |

| clientId | Set empty value | No |

| dt | Request creation time. Used to verify the signature. Should be sent in the following format: yyyymmddhhmmss (for example, 20181208130724) | Yes |

| signature | Request signature. Required to verify the legality of the request. Description of creating signature see above in section 2.2 "Signature" | Yes |

| mode | Set "1111" for asynchronous mode | No |

| attribute1 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute2 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute3 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute4 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute5 | Used to send the split parameters of the payment (see section "Splitting the payment" for details) | No |

| lang | Payment system interface language: uk – Ukrainian, en – English,az – Azerbaijani, kz – Kazakh | No |

Response structure:

Please, refer to "3.1.1 Payment by card response" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| shopBillId | A unique identifier (ID) assigned to each transaction (payment document) in the Portmone.com system |

| shopOrderNumber | Number of paid order (bill) in the Partner’s system |

| description | Comment to the order/ description of payment details |

| cardMask | Payer’s Card mask |

| billAmount | Transaction amount sent in request |

| authCode | Bank authorization code (added if the order is paid) |

| status | Order status. Possible values: PAYED, PREAUTH, REJECTED, CREATED |

| token | Token value for subsequent payments |

| MD | Parameter which should be sent to acsUrl for 3D Secure check |

| PaReq | Parameter which should be sent to acsUrl for 3D Secure check |

| is3DS | 3DS-authorization flag ("Y" – 3D Secure check is required, "N" – 3D Secure check is not required) |

| acsUrl | The card issuing bank page URL to which client should be redirected to confirm payment with 3D Secure |

| attribute1 | Service field (for additional order information). Filled at company’s discretion |

| attribute2 | Service field (for additional order information). Filled at company’s discretion |

| attribute3 | Service field (for additional order information). Filled at company’s discretion |

| attribute4 | Service field (for additional order information). Filled at company’s discretion |

| attribute5 | Used to send the split parameters of the payment (see section "Splitting the payment" for details) |

| errorCode | Error code (0 if payment was successful) |

| error | Error description |

3.1.2. Redirect to ACS

To proceed with 3DS verification Client should be redirected to the Issuing Bank website. To do so Partner should create a form and send it by POST method to Client’s browser.

Example:

var f = document.createElement("form");

f.setAttribute('method',"POST");

f.setAttribute('action',response.acsUrl);

var i = document.createElement("input");

i.setAttribute('type',"hidden");

i.setAttribute('name',"MD");

i.setAttribute('value',response.MD);

var i1 = document.createElement("input");

i1.setAttribute('type',"hidden");

i1.setAttribute('name',"TermUrl");

i1.setAttribute('value',TermUrl);

var i2 = document.createElement("input");

i2.setAttribute('type',"hidden");

i2.setAttribute('name',"PaReq");

i2.setAttribute('value',response.PaReq);

f.appendChild(i);

f.appendChild(i1);

f.appendChild(i2);

document.body.appendChild(f);

f.submit();

where acsUrl, MD, PaReq – values received in PSP response, TermUrl – your result URL to return from the bank page.

As soon as 3DS-check is passed and Client is returned on TermUrl link, Complete Payment Request to PSP should be sent (see section 3.1.3 "Complete payment").

3.1.3. Complete payment

Description:

To complete a payment you should send a request to the following URL: https://www.portmone.com.ua/r3/pm-mpi/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "3.1.3 Complete payment request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| id | Order ID in the Portmone.com system | Yes |

| PaRes | The PaRes value received from the bank to your URL | Yes |

| MD | The MD value received from the bank to your URL | Yes |

Response structure:

Please, refer to "3.1.3 Complete payment response (successful)" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| shopBillId | A unique identifier (ID) assigned to each transaction (payment document) in the Portmone.com system |

| shopOrderNumber | Number of paid order (bill) in the Partner’s system |

| description | Comment to the order / description of payment details |

| cardMask | Payer’s Card mask |

| billAmount | Transaction amount sent in request |

| authCode | Bank authorization code (added if the order is paid) |

| status | Order status |

| receiptUrl | Link to get a receipt |

| attribute1 | Service field (for additional order information). Filled at company’s discretion |

| attribute2 | Service field (for additional order information). Filled at company’s discretion |

| attribute3 | Service field (for additional order information). Filled at company’s discretion |

| attribute4 | Service field (for additional order information). Filled at company’s discretion |

| attribute5 | Used to send the split parameters of the payment (see section "Splitting the payment" for details) |

| errorCode | Error code (0 if payment was successful) |

| error | Error description |

| is3DS | 3DS-authorization flag ("Y" – 3D Secure check is required, "N" – 3D Secure check is not required) |

3.2. Create Token

Description:

This method allows you to get a value of the Token and the Client’s card mask. After performing this payment method, you will get the Token value and the mask of the Client’s Payment Card, which you can offer to the Client as a payment method on your resource. In the process of performing token creation operation, Portmone.com will perform authorization hold for 1 UAH on the Client's card, with the subsequent return of this amount to the Client's card.

Request should be sent at: https://www.portmone.com.ua/r3/pm/.

Availability and restrictions:

The description field sent by this method is the key to further payments by Token. It must be the same for further transactions as was provided in the first transaction. If this parameter is changed in further payments by Token, Client will receive an error message.

Request structure:

Please, refer to "3.2 createToken request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| paymentType | To create a Token, you must set the value to "createToken" for this parameter | Yes |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system | Yes |

| shopOrderNumber | Number of paid order in the Partner’s system | No |

| billAmount | Amount of the payment | Yes |

| emailAddress | Email address of the payer | No |

| shopSiteId | Digital identifier of a sales channel. Set empty value | No |

| billCurrency | Currency of the payment. Default value: UAH | No |

| description | Payment description (comment to the order /payment details) | Required, identifies the Token in subsequent payments |

| token | Set empty value | No |

| cardData | Encrypted value of payment card data (card number, expiration month, expiration year, CVV2) | Yes |

| preauthFlag | Payment pre-authorization flag. Set empty value | No |

| cvvVerifyFlag | The default is "Y", set "N" if need operation without CVV2 | No |

| clientId | Set empty value | Yes |

| dt | Request creation time. Used to verify the signature. Should be sent in the following format: yyyymmddhhmmss (for example, 20181208130724) | Yes |

| signature | Request signature. Required to verify the legality of the request. Description of creating signature see above in section 2.2 "Signature" | Yes |

| attribute1 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute2 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute3 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute4 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute5 | Used to send the split parameters of the payment (see section "Splitting the payment" for details) | No |

Response structure:

Please, refer to "3.2 createToken response" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| is3DS | 3DS-authorization flag ("Y" – 3D Secure check is required, "N" – 3D Secure check is not required) |

| shopBillId | A unique identifier (ID) assigned to each transaction (payment document) in the Portmone.com system |

| shopOrderNumber | Number of paid order (bill) in the Partner’s system |

| description | Comment to the order / description of payment details |

| cardMask | Payer’s Card mask |

| billAmount | Transaction amount sent in request |

| status | Order status |

| token | Token value for subsequent payments |

| authCode | Bank authorization code (added if the order is paid) |

| mpiFlag | 3DS-authorization flag ("Y" – 3D Secure check is required, "N" – 3D Secure check is not required) |

| attribute1 | Service field (for additional order information). Filled at company’s discretion |

| attribute2 | Service field (for additional order information). Filled at company’s discretion |

| attribute3 | Service field (for additional order information). Filled at company’s discretion |

| attribute4 | Service field (for additional order information). Filled at company’s discretion |

| attribute5 | Used to send the split parameters of the payment (see section "Splitting the payment" for details) |

| errorCode | Error code (0 if payment was successful) |

| error | Error description |

3.3. Payment by Token

Description:

To make a payment via Token you should send a request to the following URL: https://www.portmone.com.ua/r3/pm/.

Availability and restrictions:

The description field should be the same as in initial payment (see section 3.2 "Create Token").

Request structure:

Please, refer to "3.3 Payment by Token request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| paymentType | Set the value to "token" for this parameter | Yes |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system | Yes |

| shopOrderNumber | Number of paid order in the Partner’s system | No |

| billAmount | Amount of the payment | Yes |

| emailAddress | Email address of the payer | No |

| shopSiteId | Digital identifier of a sales channel | No |

| billCurrency | Currency of the payment. Default value: UAH | No |

| description | Payment description (comment to the order /payment details) | Yes |

| token | Set Token value | Yes |

| cardData | Encrypted value of CVV2 | Yes |

| preauthFlag | Payment pre-authorization flag (the value "Y" indicates that this payment is carried out using the pre-authorization procedure (see section 5 "Reject/Confirm preauth payment"), the value "N" is a regular payment without pre-authorization. The default is "N") | No |

| cvvVerifyFlag | The default is "Y", set "N" if need operation without CVV2 | No |

| clientId | Set empty value | Yes |

| dt | Request creation time. Used to verify the signature. Should be sent in the following format: yyyymmddhhmmss (for example, 20181208130724) | Yes |

| signature | Request signature. Required to verify the legality of the request. Description of creating signature see above in section 2.2 "Signature" | Yes |

| mode | Set "1111" for asynchronous mode | No |

| attribute1 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute2 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute3 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute4 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute5 | Used to send the split parameters of the payment (see section "Splitting the payment" for details) | No |

Response structure:

Please, refer to "3.3 Payment by Token response (successful)" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| shopBillId | A unique identifier (ID) assigned to each transaction (payment document) in the Portmone.com system |

| shopOrderNumber | Number of paid order (bill) in the Partner’s system |

| description | Comment to the order /description of payment details |

| authCode | Bank authorization code |

| receiptUrl | Link to get a receipt |

| token | Token value |

| mpiFlag | Return "N" |

| cardMask | Payer’s Card mask |

| billAmount | Transaction amount sent in request |

| status | PAYED – successful transaction, PREAUTH – successful transaction with pre-authorization |

| attribute1 | Service field (for additional order information). Filled at company’s discretion |

| attribute2 | Service field (for additional order information). Filled at company’s discretion |

| attribute3 | Service field (for additional order information). Filled at company’s discretion |

| attribute4 | Service field (for additional order information). Filled at company’s discretion |

| attribute5 | Used to send the split parameters of the payment (see section "Splitting the payment" for details) |

| errorCode | Error code (0 if payment was successful) |

3.4. Payment by Token without CVV2 (recurring payment)

Description:

To make a recurring payment you should send a request to the following URL: https://www.portmone.com.ua/r3/recurrent/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "3.4 Recurring payment request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| paymentType | Must be set "recurrent" value | Yes |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system | Yes |

| shopOrderNumber | Number of paid order (bill) in the Partner’s system | No |

| billAmount | Amount of the payment | Yes |

| emailAddress | Email address of the payer | No |

| shopSiteId | Digital identifier of a sales channel | No |

| billCurrency | Currency of the payment. Default value: UAH | No |

| description | Comment to the order/ description of payment details (should be the same as in initial payment) | Yes |

| token | Set Token value | Yes |

| cardData | Set empty value | No |

| preauthFlag | Payment pre-authorization flag (the value "Y" indicates that this payment is carried out using the pre-authorization procedure (see section 5 "Reject/Confirm preauth payment"), the value "N" is a regular payment without pre-authorization. The default is "N") | No |

| cvvVerifyFlag | Set "N" if need operation without CVV2 | Yes |

| clientId | Set empty value | Yes |

| dt | Request creation time. Used to verify the signature. Should be sent in the following format: yyyymmddhhmmss (for example, 20181208130724) | Yes |

| signature | Request signature. Required to verify the legality of the request. Description of creating signature see above in section 2.2 "Signature" | Yes |

| mode | Set "1111" for asynchronous mode | No |

| attribute1 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute2 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute3 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute4 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute5 | Used to send the split parameters of the payment (see section "Splitting the payment" for details) | No |

4. Payment via Privat24

4.1. Payment by card

Description:

To make a transaction through the Privat24 system you should send a request to the following URL: https://www.portmone.com.ua/r3/secure/gate/liq-pay.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "4.1 Payment by card request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| payee_Id | A unique identifier of the Partner | Yes |

| shop_order_number | Number of paid order (bill) in the Partner’s system | No |

| bill_amount | Amount of the order. Currency – hryvnia (UAH) | Yes |

| description | Comment to the order / description of payment details | Yes |

| lang | Privat24 system interface language. Possible values: en – English, uk – Ukrainian | Yes |

| encoding | Encoding | Yes |

| success_url | The Merchant URL address to which the client will be redirected after a successful payment | Yes |

| failure_url | The Merchant URL address to which the client will be redirected in case of payment rejection | Yes |

4.2. Create Token

Description:

To create a Token through the Privat24 system you should send a request to the following URL: https://www.portmone.com.ua/r3/secure/gate/liq-pay.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "4.2 Create token request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| payee_Id | A unique identifier of the Partner | Yes |

| shop_order_number | Number of paid order (bill) in the Partner’s system | No |

| bill_amount | Amount of the order. Currency – hryvnia (UAH). Must be set "1" value | Yes |

| description | Comment to the order / description of payment details | Yes |

| success_url | The Merchant URL address to which the client will be redirected after a successful payment | Yes |

| failure_url | The Merchant URL address to which the client will be redirected in case of payment rejection | Yes |

| revert | "Y" – refund | Yes |

| lang | Privat24 system interface language. Possible values: en – English, uk – Ukrainian | Yes |

| encoding | Encoding | Yes |

4.3. Payment by Token

Description:

To make a payment via Token you should send a request to the following URL: https://www.portmone.com.ua/r3/pm/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "4.3 Payment by Token request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| paymentType | Set the value to "token" for this parameter | Yes |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system | Yes |

| shopOrderNumber | Number of paid order in the Partner’s system | No |

| billAmount | Amount of the payment | Yes |

| emailAddress | Email address of the payer | No |

| shopSiteId | Digital identifier of a sales channel | No |

| billCurrency | Currency of the payment. Default value: UAH | No |

| description | Payment description (in case of payment by token description should be the same as in initial payment) | Yes |

| token | Set Token value | Yes |

| cardData | Encrypted value of CVV2 | Yes |

| preauthFlag | Payment pre-authorization flag (the value "Y" indicates that this payment is carried out using the pre-authorization procedure (see section 5 "Reject/Confirm preauth payment"), the value "N" is a regular payment without pre-authorization. The default is "N") | No |

| cvvVerifyFlag | The default is "Y", set "N" if need operation without CVV2 | No |

| clientId | Set empty value | Yes |

| dt | Request creation time. Used to verify the signature. Should be sent in the following format: yyyymmddhhmmss (for example, 20181208130724) | Yes |

| signature | Request signature. Required to verify the legality of the request. Description of creating signature see above in section 2.2 "Signature" | Yes |

| mode | Set "1111" for asynchronous mode | No |

| attribute1 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute2 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute3 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute4 | Service field (for additional order information). Filled at company’s discretion | No |

4.4. Payment by Token without CVV2 (recurring payment)

Description:

To make a recurring payment you should send a request to the following URL: https://www.portmone.com.ua/r3/recurrent/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "3.4 Recurring payment request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| paymentType | Must be set "recurrent" value | Yes |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system | Yes |

| shopOrderNumber | Number of paid order (bill) in the Partner’s system | No |

| billAmount | Amount of the payment | Yes |

| emailAddress | Email address of the payer | No |

| shopSiteId | Digital identifier of a sales channel | No |

| billCurrency | Currency of the payment. Default value: UAH | No |

| description | Comment to the order/ description of payment details (should be the same as in initial payment) | Yes |

| token | Set Token value | Yes |

| cardData | Set empty value | No |

| preauthFlag | Payment pre-authorization flag (the value "Y" indicates that this payment is carried out using the pre-authorization procedure (see section 5 "Reject/Confirm preauth payment"), the value "N" is a regular payment without pre-authorization. The default is "N") | No |

| cvvVerifyFlag | Set "N" if need operation without CVV2 | Yes |

| clientId | Set empty value | Yes |

| dt | Request creation time. Used to verify the signature. Should be sent in the following format: yyyymmddhhmmss (for example, 20181208130724) | Yes |

| signature | Request signature. Required to verify the legality of the request. Description of creating signature see above in section 2.2 "Signature" | Yes |

| mode | Set "1111" for asynchronous mode | No |

| attribute1 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute2 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute3 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute4 | Service field (for additional order information). Filled at company’s discretion | No |

5. Reject/Confirm preauth payment

5.1. Confirm preauth payment

Description:

To confirm preauth payment you should send the request to the following URL: https://www.portmone.com.ua/gateway/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "5.1 confirmPreauth request" to study the request structure.

Request parameters description:

| Parameter | Description |

|---|---|

| login | The Partner login to access account management |

| password | The Partner password |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system |

| shopOrderNumber | Number of paid order (bill) in the Online Store system. Maximum length is 120 symbols |

| token | Set token value |

| postauthAmount | Amount of the payment. It can not be more than the amount for which pre-authorization was carried out |

| id | ID of the request from the Partner to the Portmone.com system |

Response structure:

Please, refer to "5.1 confirmPreauth response" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| shop_bill_id | Order ID in the Portmone.com system |

| shop_order_number | Number of paid order (bill) in the Online Store system. Maximum length is 120 symbols |

| description | Order description |

| bill_date | Bill date |

| pay_date | Payment date |

| pay_order_date | Banking memorial order date |

| bill_amount | Bill amount |

| auth_code | Bank authorization code (added if the order is paid) |

| status | Order status |

| attribute1 | Service field. Filled at the company’s discretion |

| attribute2 | Service field. Filled at the company’s discretion |

| error_code | Error code |

| error_message | Error message |

5.2.Reject preauth payment

Description:

If the transaction has status "PREAUTH" use this method to move the transaction to "REJECTED" status.

URL for request: https://www.portmone.com.ua/gateway/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "5.2 rejectPreauth request" to study the request structure.

Request parameters description:

| Parameter | Description |

|---|---|

| method | Required parameter to call the cancellation of payment with pre-authorization procedure. Value: rejectPreauth |

| login | The Partner login to access account management |

| password | The Partner password |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system |

| shopOrderNumber | Number of paid order (bill) in the Partner’s system |

| id | ID of the request from the Partner to the Portmone.com system |

Response structure:

Please, refer to "5.2 rejectPreauth response (successful)" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| description | Order description |

| status | Order status |

| attribute1-4 | Service fields (for additional order information) |

| commission | The value of the refunded commission from payment |

| shopBillId | Order ID in the Portmone.com system |

| shopOrderNumber | Number of paid order (bill) in the Partner’s system |

| billAmount | Bill amount |

| errorCode | Error code |

| errorMessage | Error message |

| authCode | Bank authorization code (added if the order is paid) |

| cardMask | Payer’s Card mask |

| token | Token value |

6. Receipt of payment token after payment

6.1. getToken

Description:

This method is used to obtain the Token by order number (shopOrderNumber).

You should send a request to the following URL: https://www.portmone.com.ua/r3/recurrent/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "6.1 getToken request (example for PHP)" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| method | To obtain a Token, you must set the value to "getToken" for this parameter | Yes |

| login | The Partner login to access account management | Yes |

| password | The Partner password | Yes |

| shopOrderNumber | Number of paid order (bill) in the Partnet’s system. Maximum length is 120 symbols | Yes |

| id | ID of the request from the Partner to the Portmone.com system | Yes |

Response structure:

Please, refer to "6.1 getToken response (tokenType: CARD)" and to "6.1 getToken response (tokenType: PRIVAT24)" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| cardMask | Payer’s Card mask |

| billAmount | Transaction amount sent in request |

| billCurrency | Currency of the payment |

| token | Token value for subsequent payments |

| tokenType | CARD – in case of card payments, PRIVAT24 – in case of Privat24 payments |

| id | ID of the request from the Partner to the Portmone.com system |

6.2. getTokens

Description:

This method is used to obtain all tokens by description (description).

You should send a request to the following URL: https://www.portmone.com.ua/r3/api/gateway/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "6.2 getTokens request (example for PHP)" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| method | Must be set "getTokens" value | Yes |

| login | The Partner login to access account management | Yes |

| password | The Partner password | Yes |

| description | Payment description (comment to the order /payment details) | Yes |

| signature | Request signature. Required to verify the legality of the request. Description of creating signature see above in section 2.2 "Signature" and use fields from the example of signature below | Yes |

| dt | Request creation time. Should be sent in the following format: yyyymmddhhmmss (for example, 20181208130724) | Yes |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system | Yes |

| id | ID of the request from the Partner to the Portmone.com system | Yes |

Example of signature [PHP]:

$strToSignature = $payeeId.$dt.bin2hex($clientId);

$strToSignature = strtoupper($strToSignature).strtoupper(bin2hex($login));

$signature = strtoupper(hash_hmac('sha256', $strToSignature, $key));

Response structure:

Please, refer to "6.2 getTokens response to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| cardMask | Payer’s Card mask |

| billAmount | Amount of the payment |

| billCurrency | Currency of the payment. Default value: UAH |

| token | Token value |

| tokenType | CARD – in case of card payments, PRIVAT24 – in case of Privat24 payments |

| id | ID of the request from the Partner to the Portmone.com system |

6.3. Getting IPS data by Portmone token

Description:

The request must be sent to the URL: https://www.portmone.com.ua/r3/api/gateway.

Availability and restrictions:

Available after a card payment is made.

JSON request structure:

{

"method":"getDataTokenIPS",

"params":{

"data":{

"login":${MERCHANT_LOGIN},

"password":${MERCHANT_PASSWORD},

"tokenType":"PORTMONE",

"tokenReference":${TOKEN_REFERENCE}

}

},

"id":"1"

}

Request parameters description:

| Parameter | Description |

|---|---|

| MERCHANT_LOGIN | Merchant's login in the Portmone system |

| MERCHANT_PASSWORD | Merchant's password in the Portmone system |

| TOKEN_REFERENCE | Card token, returned by the Portmone system |

Response structure and example (Mastercard):

{

"result": {

"token_type": "M4M",

"token_info": {

"tokenUniqueReference": "DM4MMC0000****ed8d7249e",

"panUniqueReference": "FM4MMC000012971373*****6a75a3cf",

"productConfig": {

"termsAndConditionsUrl": "",

"issuerName": ",

"cardBackgroundCombinedAssetId": "954e89****8655a",

"iconAssetId": "7fcf53be****cf1fbfe",

"foregroundColor": "ffffff",

"issuerLogoAssetId": "cd90eb72****5cc1",

"shortDescription": "",

"customerServiceEmail": "",

"customerServicePhoneNumber": "",

"customerServiceUrl": "",

"isCoBranded": "false",

"brandLogoAssetId": "3789637f****c509"

},

"tokenInfo": {

"tokenPanSuffix": "4444",

"accountPanSuffix": "4444",

"tokenExpiry": "0823",

"accountPanExpiry": "",

"productCategory": "DEBIT",

"dsrpCapable": true,

"tokenAssuranceLevel": ""

}

}

},

"id": "1"

}

Response key parameters description:

| Parameter | Description |

|---|---|

| TOKEN_TYPE | Token type depending on the IPS |

| id | Unique response ID |

Response structure and example (Visa):

{

"result": {

"token_type": "VTS",

"token_info": {

"vPanEnrollmentID": "724bfc****38701",

"paymentInstrument": {

"expirationDate": {

"month": "11",

"year": "2023"

},

"last4": "1111",

"cvv2PrintedInd": "Y",

"expDatePrintedInd": "Y",

"enabledServices": {

"merchantPresentedQR": "N"

}

},

"cardMetaData": {

"backgroundColor": "0xffff00",

"foregroundColor": "0x000000",

"labelColor": "0x000000",

"contactWebsite": "https://www.aval.ua",

"contactEmail": "[email protected]",

"contactNumber": "+380444908888",

"contactName": "Raiffeisen Bank Aval",

"privacyPolicyURL": "https://www.aval.ua/storage/files/politika-konfidencijnosti-04042019_1554448866.pdf",

"termsAndConditionsURL": "https://aval.ua/storage/files/wallet-pi.pdf",

"shortDescription": "Visa Classic",

"cardData": [

{

"guid": "8407fa4e5****d705f6cb07",

"contentType": "cardSymbol",

"content": [

{

"mimeType": "image/png",

"width": "100",

"height": "100"

}

]

},

{

"guid": "09e037d****c17995ddf6",

"contentType": "digitalCardArt",

"content": [

{

"mimeType": "image/png",

"width": "1536",

"height": "969"

}

]

}

],

"issuerFlags": {

"deviceBinding": false,

"cardholderVerification": false,

"trustedBeneficiaryEnrollment": false,

"delegatedAuthenticationSupported": true

}

},

"vProvisionedTokenID": "ebc77cd5****bcc8885e01",

"tokenInfo": {

"tokenRequestorID": "1111111111",

"tokenStatus": "ACTIVE",

"last4": "",

"expirationDate": {

"month": "",

"year": ""

}

}

}

},

"id": "1"

}

Response key parameters description:

| Parameter | Description |

|---|---|

| TOKEN_TYPE | Token type depending on the IPS |

| id | Unique response ID |

| tokenInfo, cardMetaData, cardData | Card meta data |

6.4. Getting an asset by the unique IPS ID

Description:

The request must be sent to the URL: https://www.portmone.com.ua/r3/api/gateway.

Availability and restrictions:

Available after getting the IPS ID using getDataTokenIPS method according to p. 4.5. For getting an asset of each type it is necessary to make unique request containing the corresponding ID.

JSON request structure and example:

{

"method":"getMetaDataTokenIPS",

"params":{

"data":{

"login":${MERCHANT_LOGIN},

"password":${MERCHANT_PASSWORD},

"tokenType":${TOKEN_TYPE},

"metaDataId":${ASSET_ID}

}

},

"id":"1"

}

Request parameters description:

| Parameter | Description |

|---|---|

| MERCHANT_LOGIN | Merchant’s login in the Portmone system |

| MERCHANT_PASSWORD | Merchant’s password in the Portmone system |

| TOKEN_TYPE | Token type received using getDataTokenIPS method according to p. 4.5 |

| ASSET_ID: | Asset ID received using getDataTokenIPS method according to p. 4.5 (AssetId\guid) |

Response structure and example:

{

"result": {

"mediaContents": [

{

"data": "", //Base64 encoded content

"width": 1536,

"type": "image\/png",

"height": 969

}

]

},

"id": "1"

}

7. Transfer of funds from account to card (token)

Description: Allows you to transfer funds from an account to a Card or a Card Token. Merchant needs to sign an agreement with Bank.

** Important! ** When using this service, merchants become tax agents and are obliged to pay taxes (Income tax, SSC, Military tax). Exceptions are companies that have a license to carry out a special type of activity such as: MFIs (microcredit organizations), insurance companies .

7.1 Transfer of funds from account to card

Description:

To transfer funds you should send a request to the following URL: https://www.portmone.com.ua/r3/pm/.

Availability and restrictions:

The method works in synchronous mode only (mode = 1101).

Request structure:

Please, refer to "7.1 Request to transfer funds from account to card" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| paymentType | Must be set "a2c" value | Yes |

| description | Payment description (comment to the order/ payment details) | Yes |

| attribute1 | Service field (for additional order information). Set empty value | No |

| attribute2 | Service field (for additional order information). The information about tax for transfer on a card | No |

| attribute3 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute4 | Service field (for additional order information). Filled at company’s discretion | No |

| billAmount | Amount of the payment | Yes |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system | Yes |

| shopOrderNumber | Number of paid order in the Partner’s system | No |

| cvvVerifyFlag | The default is "Y", set "N" for payments without CVV2 | No |

| token | Set empty value | No |

| billCurrency | Currency of the payment. Default value: UAH | No |

| shopSiteId | Digital identifier of a sales channel | No |

| cardData | Encrypted value of payment card data (card number, expiration month, expiration year, CVV2) | No |

| dt | Request creation time. Used to verify the signature. Should be sent in the following format:yyyymmddhhmmss (for example, 20181208130724) | Yes |

| signature | Request signature. Required to verify the legality of the request. Description of creating signature see above in section 2.2 "Signature" | Yes |

| mode | Set "1101" for synchronous mode | Yes |

In case of tax payment in attribute2 it is necessary to transfer the following parameters:

"attribute2": "\" client_id \ ": \" Ivanov Ivan \ ", \" taxes \ ": {\"income\ ": 20, \" social \": 10,\"military\": 5},\"identification\": {\"general\": {\"tax_id\":\"1234567890 \"}} ",

Description of query parameters: | Option | Description | Required | | -------- | -------- |: ----------: | | client_id | Recipient's name | Yes | | Income | The amount of income tax in coins| Yes | | Social | The amount of SSC in coins | Yes | | military | The amount of military tax in coins | Yes | | tax_id | TIN of the recipient of funds | Yes |

** Important! ** In case of cashback (bonuses) it is not necessary to transfer the social parameter.

Response structure:

Please, refer to "7.1 Transfer funds from account to card. Response (successful)" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| status | Order status. Possible values: REJECTED, PAYED |

| errorCode | Error code (0 if payment was successful) |

| error | Error description |

| shopBillId | A unique identifier (ID) assigned to each transaction (payment document) in the Portmone.com system |

| billAmount | Transaction amount sent in request |

| billNumber | Number of paid order (bill) in the Partner’s system |

| attribute1 | Service field (for additional order information). Set empty value |

| attribute2 | Service field (for additional order information). The information about tax for transfer on a card |

| attribute3 | Service field (for additional order information). Filled at company’s discretion |

| attribute4 | Service field (for additional order information). Filled at company’s discretion |

| authCode | Bank authorization code (added if the order is paid) |

| payeeExportFlag | Transaction status in the acquiring bank (Y – successful, E – error, N or empty value – not sent) |

| receiptLink | Link to get a receipt |

| billCurrency | Currency of the payment |

| transactionId | Transaction ID in the acquirer system |

Important! If the response contains

status = PAYED, butpayeeExportFlaghas a value other than Y, it is necessary to request the transaction status from the Portmone.com system (see section 9.1.2 "JSON request"). If the response containsstatus = PAYEDandpayee_export_flag = Y, the transaction is successful.

7.2 Transfer of funds from account to card token

Description: To get card token you can use paragraph 3.2 of documentation

** Important! ** Do not fill the description parameter when send request to get a token and request a transfer.

To transfer funds you should send a request to the following URL: https://www.portmone.com.ua/r3/pm/.

Availability and restrictions:

The method works in synchronous mode only (mode = 1101).

Request structure:

Please, refer to "7.2 Request to transfer funds from account to card" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| paymentType | Must be set "a2t_1» value | Yes |

| description | Set empty value | Yes |

| attribute1 | Service field (for additional order information). Set empty value | No |

| attribute2 | Service field (for additional order information). The information about tax for transfer on a card token | No |

| attribute3 | Service field (for additional order information). Filled at company’s discretion | No |

| attribute4 | Service field (for additional order information). Filled at company’s discretion | No |

| billAmount | Amount of the payment | Yes |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system | Yes |

| shopOrderNumber | Number of paid order in the Partner’s system | No |

| cvvVerifyFlag | The default is "Y", set "N" for payments without CVV2 | No |

| token | Set empty value | No |

| billCurrency | Currency of the payment. Default value: UAH | No |

| shopSiteId | Digital identifier of a sales channel | No |

| cardData | Encrypted value of payment card data (card number, expiration month, expiration year, CVV2) | No |

| dt | Request creation time. Used to verify the signature. Should be sent in the following format: yyyymmddhhmmss (for example, 20181208130724) | Yes |

| signature | Request signature. Required to verify the legality of the request. Description of creating signature see above in section 2.2 "Signature" | Yes |

| mode | Set "1101" for synchronous mode | Yes |

In case of tax payment in attribute2 it is necessary to transfer the following parameters:

"attribute2": "\" client_id \ ": \" Ivanov Ivan \ ", \" taxes \ ": {\" income \ ": 20, \" social\": 10,\"military\":5},\"identification\": {\"general\": {\"tax_id\": \"1234567890 \"}} ",

Description of query parameters:

| Option | Description | Required | | -------- | -------- |: ----------: | | client_id | Recipient's name | Yes | | Income | The amount of income tax in coins| Yes | | Social | The amount of SSC in coins | Yes | | military | The amount of military tax in coins | Yes | | tax_id | TIN of the recipient of funds | Yes |

** Important! ** In case of cashback (bonuses) it is not necessary to transfer the social parameter.

Response structure:

Please, refer to «7.2 Transfer funds from account to card token. Response (successful)" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| status | Order status. Possible values: REJECTED, PAYED |

| errorCode | Error code (0 if payment was successful) |

| error | Error description |

| shopBillId | A unique identifier (ID) assigned to each transaction (payment document) in the Portmone.com system |

| billAmount | Transaction amount sent in request |

| billNumber | Number of paid order (bill) in the Partner’s system |

| attribute1 | Service field (for additional order information). Filled at company’s discretion |

| attribute2 | Service field (for additional order information). The information about tax for transfer on a card token |

| attribute3 | Service field (for additional order information). Filled at company’s discretion |

| attribute4 | Service field (for additional order information). Filled at company’s discretion |

| authCode | Bank authorization code (added if the order is paid) |

| payeeExportFlag | Transaction status in the acquiring bank (Y – successful, E – error, N or empty value – not sent) |

| receiptLink | Link to get a receipt |

| billCurrency | Currency of the payment |

| transactionId | Transaction ID in the acquirer system |

Important! If the response contains

status = PAYED, butpayeeExportFlaghas a value other than Y, it is necessary to request the transaction status from the Portmone.com system (see section 9.1.2 "JSON request"). If the response containsstatus = PAYEDandpayee_export_flag = Y, the transaction is successful.

8. Return

8.1 POST request

Description:

URL for the request: https://www.portmone.com.ua/gateway/.

Request format: HTTPS POST

Availability and restrictions:

This method is available for transactions with status "PAYED" during 31 days after payment was made.

Request structure:

Please, refer to "8.1 POST return request" to study the request structure.

Request parameters description:

| Parameter | Description | Required |

|---|---|---|

| method | Required parameter to call the return procedure. Value: return | Yes |

| login | The Partner login | Yes |

| password | The Partner password | Yes |

| shop_bill_id | Order number in the Portmone.com system (should be obtained using the result method described in section 9.1 "Authorization results request") | Yes |

| return_amount | Return amount | Yes |

| attribute1 | Additional optional parameter | No |

| encoding | Encoding | Yes |

| lang | Error message language | Yes |

Response structure:

Please, refer to "8.1 POST return response (successful)" to study the response structure.

If error occurs when calling a method (for example, incorrect login, etc.), the <order> section will consist of two tags only — <error_code> and <error_message> (see "8.1 POST return response (failure)").

Response parameters description:

| Parameter | Description |

|---|---|

| method | Required parameter to call the return procedure. Value: return |

| login | The Partner login |

| password | The Partner password |

| shop_bill_id | Order number in the Portmone.com system |

| return_amount | Return amount |

| attribute1 | Additional optional parameter |

| encoding | Encoding |

| lang | Error message language |

| shop_order_number | Number of an order (bill) in the Partner’s system. Maximum length is 120 symbols |

| description | Order description |

| bill_date | Bill date (date the order was created) |

| pay_date | Payment date (date the order was paid) |

| bill_amount | Bill amount to return |

| auth_code | Bank authorization code |

| status | Order status |

| error_code | Error code (0 if payment was successful) |

| error_message | Error message |

8.2. JSON request

Description:

This method returns money by the transaction and it is better to call it the next day after the transaction. This method initiates new transaction in Portmone.com, which returns the money to the Client, and id of this transaction returns as shopBillId with status RETURN.

URL for the request: https://www.portmone.com.ua/gateway/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "8.2 JSON return request" to study the request structure.

Request parameters description:

| Parameter | Description |

|---|---|

| login | The Partner login to access account management |

| password | The Partner password |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system |

| shopOrderNumber | Number of an order (bill) in the Partner’s system. Maximum length is 120 symbols |

| returnAmount | Return amount |

| message | Return reason |

| id | ID of the request |

Response structure:

Please, refer to "8.2 Response format" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| description | Order description |

| status | Order status |

| attribute1-4 | Service fields (for additional order information) |

| commission | The value of the refunded commission from the payment |

| shopBillId | Order ID in the Portmone.com system |

| shopOrderNumber | Number of an order (bill) in the Partner’s system. Maximum length is 120 symbols |

| billAmount | Bill amount |

| error_code | Error code |

| error_message | Error message |

| auth_code | Bank authorization code (added if the order is paid) |

| token | Token value |

| cardMask | Payer's Card mask |

9. Getting authorization results

Merchants can receive authorization results in several ways:

- when Client returns to Merchant’s website after payment;

- by sending XML-request to the Portmone.com system;

- by XML-message from the Portmone.com system to the Partner with the result of authorization (XML-notification of payment);

- by XML-message from the Portmone.com system to the Partner about a payment order (XML-notification of transactions financial coverage);

- by JSON-request from the Portmone.com system to the Partner.

9.1. Authorization results request

9.1.1. POST request

Description:

To receive payment status you should send a POST request to the following URL: https://www.portmone.com.ua/gateway/.

Availability and restrictions:

The maximum request period should not exceed 31 days.

Request structure:

Please, refer to "9.1.1 POST authorization results request" to study the request structure.

Request parameters description:

| Parameter | Description |

|---|---|

| method | Required parameter to call the report generation procedure. Value: result |

| payee_id | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system |

| login | The Partner login to access account management |

| password | The Partner password |

| shop_order_number | Number of an order in the Partner's system. If you do not specify this value, orders will be selected without reference to their numbers |

| status | Status of the order to be included in the report. Possible values: - PAYED – paid, - CREATED – created, - REJECTED – rejected. By default, orders with all types of statuses are selected. |

| start_date | Start date of the report in dd.mm.yyyy format. By default, it’s the current date of the last month |

| end_date | End date of the report in dd.mm.yyyy format. By default, it’s the current date |

Response structure:

Please, refer to "9.1.1 POST authorization results response" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| shop_bill_id | Order ID in the Portmone.com system |

| shop_order_number | Number of paid order (bill) in the Partner's system |

| description | Order description |

| bill_date | Bill date |

| pay_date | Payment date |

| bill_amount | Bill amount |

| auth_code | Bank authorization code (added if the order is paid) |

| status | Order status |

| error_code | Error code |

| error_message | Error message |

9.1.2.JSON request

Description:

To receive payment status or a list of transactions for a company you should send a request to the following URL: https://www.portmone.com.ua/gateway/.

Availability and restrictions:

No restrictions.

Request structure:

Please, refer to "9.1.2 JSON authorization results request" to study the request structure.

Request parameters description:

| Parameter | Description |

|---|---|

| method | Required parameter to call the report generation procedure. Value: result |

| login | The Partner login to access account management |

| password | The Partner password |

| payeeId | A unique identifier of the Partner. Assigned to each Partner individually when connected to the Portmone.com system |

| shopOrderNumber | Number of an order in the Online Store. If you do not specify this value, orders will be selected without reference to their numbers |

| status | Status of the order to be included in the report. Possible values: - PAYED – paid, - CREATED – created, - REJECTED – rejected. By default, orders with all types of statuses are selected. |

| start_date | Start date of the report in dd.mm.yyyy format. By default, it’s the current date of the last month |

| end_date | End date of the report in dd.mm.yyyy format. By default, it’s the current date |

| id | Id of the request from the Online Store to the Portmone.com system |

Response structure:

Please, refer to "9.1.2 JSON authorization results response (successful)" to study the response structure.

Response parameters description:

| Parameter | Description |

|---|---|

| description | Order description |

| status | Order status |

| attribute1 | Service field. Filled at company's discretion |

| attribute2 | Service field. Filled at company's discretion |

| attribute3 | Service field. Filled at company's discretion |

| attribute4 | Service field. Filled at company's discretion |

| commission | The value of the refunded commission from payment |

| pay_date | Payment date |

| payee_export_date | Date of sending the payment amount / payment notification to the Partner |

| payee_export_flag | Status of sending to the Partner (Y – successful, E – error, N or empty value – not sent) |

| pay_order_date | Bank memorial order date |

| chargeback | Whether the chargeback was claimed for transaction or not |

| shopBillId | Order ID in the Portmone.com system |

| shopOrderNumber | Number of paid order (bill) in the Online Store |

| billAmount | Bill amount |

| errorCode | Error code |

| errorMessage | Error message |

| authCode | Bank authorization code (added if the order is paid) |

| cardMask | Payer’s Card mask |

| token | Token value for subsequent payments |

9.2. XML-notifications

Notification for successful payment – BILLS message

Description:

The system of XML-messages transferred by HTTPS protocol is used to exchange the information. The Portmone.com system is always the initiator of such exchange. The company shall provide URL-address to which the Portmone.com system will send XML-messages using POST method via data parameter.

Example:

data=<?xml version="1.0" encoding="UTF-8"?><BILLS> …..

The BILLS message is sent by Portmone.com to the company in case of successful transaction. Intended to receive information about the accepted payment, without waiting for the funds to be transferred to the company’s current account. Message contains information about a single paid bill.

Message structure:

Please, refer to "9.2 Notification for successful payment – BILLS message" to study the message structure.

Message BILLS – fields description:

| Field name | Data type | Description |

|---|---|---|

| PAYEE\NAME | CHAR(100) | Name of a payee’s company |

| PAYEE\CODE | NUMBER(15,0) | Company code (provided by Portmone.com system) |

| BANK\NAME | CHAR(100) | Name of sender's bank |

| BANK\CODE | CHAR(6) | MFO of sender's bank |

| BANK\ACCOUNT | CHAR(20) | Sender's bank account number |

| BILL_ID | NUMBER(15,0) | Unique bill ID in the Portmone system. The company must verify that the BILL_ID is unique and should not allow to register two messages with the same BILL_ID |

| BILL_NUMBER | CHAR(120) | Bill number |

| BILL_DATE | CHAR(10) | Bill date in YYYY-MM-DD format |

| BILL_PERIOD | CHAR(4) | Bill period in MMYY (month and year) format |

| PAY_DATE | CHAR(10) | Date of payment in YYYY-MM-DD format |

| PAYED_AMOUNT | NUMBER(15,2) | Amount of payment. Use dot (".") as the decimal separator |

| PAYED_COMMISSION | NUMBER(15,2) | Amount of banking commission. Always equal to 0 |

| PAYED_DEBT | NUMBER(15,2) | Including payment of debt. Use dot (".") as the decimal separator |

| AUTH_CODE | CHAR(6) | Authorization code for a payment card |

| CONTRACT_NUMBER | CHAR(20) | Parameter by which the company and the Portmone.com system agreed to identify the client |

| ATTRIBUTE1 | CHAR(20) | Additional client identification parameter. If it is not required for client identification, it will not be sent in a message |

| ATTRIBUTE2 | CHAR(20) | Additional client identification parameter. If it is not required for client identification, it will not be sent in a message |

| ATTRIBUTE3 | CHAR(20) | Additional client identification parameter. If it is not required for client identification, it will not be sent in a message |

| ATTRIBUTE4 | CHAR(20) | Additional client identification parameter. If it is not required for client identification, it will not be sent in a message |

Examples:

See "9.2 BILLS message example".

Notification about bank payment – PAY_ORDERS message

Description:

The system of XML-messages transferred by HTTPS protocol is used to exchange the information. The Portmone.com system is always the initiator of such exchange. The company shall provide URL-address to which the Portmone.com system will send XML-messages using POST method via data parameter.

Example:

data=<?xml version="1.0" encoding="UTF-8"?><PAY_ORDERS> …..

Message PAY_ORDERS is sent by the Portmone.com system to the company and contains information about bank payments. This message is used to compare BILLS messages with funds transferred by the bank to the current account of the company. It contains information about a single paid bill.

Message structure:

Please, refer to "9.2 Notification about bank payment – PAY_ORDERS message" to study the message structure.

Message PAY_ORDERS – fields description:

| Field name | Data type | Description |

|---|---|---|

| PAY_ORDER_ID | NUMBER(15,0) | Payment order ID. The company must verify that the PAY_ORDER_ID is unique and should not allow to register two messages with the same PAY_ORDER_ID |

| PAY_ORDER_DATE | CHAR(10) | Date of payment order in YYYY-MM-DD format |

| PAY_ORDER_NUMBER | CHAR(20) | Number of payment order |

| PAY_ORDER_AMOUNT | NUMBER(15,2) | The amount of payment order. Use dot (".") as the decimal separator |

| PAYEE\NAME | CHAR(100) | Name of a payee’s company |

| PAYEE\CODE | NUMBER(15,0) | Company code (provided by the Portmone.com system) |

| BANK\NAME | CHAR(100) | Name of sender's bank |

| BANK\CODE | CHAR(6) | MFO of sender's bank |

| BANK\ACCOUNT | CHAR(20) | Sender's bank account number |

| BILL_ID | NUMBER(15,0) | Unique bill ID in the Portmone system. The company must verify that the BILL_ID is unique and should not allow to register two messages with the same BILL_ID |

| BILL_NUMBER | CHAR(120) | Bill number |

| BILL_DATE | CHAR(10) | Bill date in YYYY-MM-DD format |

| BILL_PERIOD | CHAR(4) | Bill period in MMYY (month and year) format |

| PAY_DATE | CHAR(10) | Date of payment in YYYY-MM-DD format |

| PAYED_AMOUNT | NUMBER(15,2) | Amount of payment. Use dot (".") as the decimal separator |

| PAYED_COMMISSION | NUMBER(15,2) | Amount of banking commission |

| PAYED_DEBT | NUMBER(15,2) | Including payment of debt. Use dot (".") as the decimal separator |

| AUTH_CODE | CHAR(6) | Authorization code for a payment card |

| CONTRACT_NUMBER | CHAR(20) | Parameter by which the company and the Portmone.com system agreed to identify the client |

| ATTRIBUTE1 | CHAR(20) | Additional client identification parameter. If it is not required for client identification, it will not be sent in a message |

| ATTRIBUTE2 | CHAR(20) | Additional client identification parameter. If it is not required for client identification, it will not be sent in a message |

| ATTRIBUTE3 | CHAR(20) | Additional client identification parameter. If it is not required for client identification, it will not be sent in a message |

| ATTRIBUTE4 | CHAR(20) | Additional client identification parameter. If it is not required for client identification, it will not be sent in a message |

Examples:

See "9.2 PAY_ORDERS message example".

Confirmation of payment information receipt – RESULT message

Description:

The RESULT message is sent by the company to the Portmone.com system in response to the messages PAY_ORDERS and BILLS.

Message structure:

Please, refer to "9.2 Confirmation of payment information receipt – RESULT message" to study the message structure.

Message RESULT – fields description:

| Field name | Data type | Description |

|---|---|---|

| ERROR_CODE | NUMBER(15,0) | Error code (0 in case if message processing is successful) |

| REASON | CHAR(250) | Error description |

Examples:

See "9.2 RESULT message example".

9.3. Notification in JSON format

Notification for successful payment in JSON format

Description:

This notification is sent by Portmone.com to the company in case of successful transaction. The company shall provide URL-address to which the Portmone.com system will send messages in JSON format.

Message structure:

Please, refer to "9.3 Notification for successful payment in JSON format" to study the message structure.

Parameters description:

| Parameter | Description |

|---|---|

| shopBillId | A unique identifier (ID) assigned to each transaction (payment document) in the Portmone.com system |

| shopOrderNumber | Number of paid order (bill) in the Partner’s system |

| description | Comment to the order / description of payment details |

| cardMask | Payer’s Card mask |

| billAmount | Transaction amount sent in request |

| status | Order status. Possible values: PAYED, PREAUTH, REJECTED, CREATED |

| token | Token value for subsequent payments |

| tokenType | Token type. Possible values are: - CARD - in case of card payments, - PRIVAT24 - in case of Privat24 payments. |

| MD | Parameter which should be sent to acsUrl for 3D Secure check |

| PaReq | Parameter which should be sent to acsUrl for 3D Secure check |

| is3DS | 3DS-authorization flag ("Y" – 3D Secure check is required, "N" – 3D Secure check is not required) |

| acsUrl | The card issuing bank page URL to which client should be redirected to confirm payment with 3D Secure |

| attribute1 | Service field (for additional order information). Filled at company’s discretion |

| attribute2 | Service field (for additional order information). Filled at company’s discretion |

| attribute3 | Service field (for additional order information). Filled at company’s discretion |

| attribute4 | Service field (for additional order information). Filled at company’s discretion |

| errorCode | Error code (0 if payment was successful) |

| error | Error description |

Confirmation of receipt of payment notification in JSON format

Description:

This message is sent by the company to the Portmone.com system in response to the notification for successful payment in JSON format.

Message structure:

Please, refer to "9.3 Confirmation of receipt of payment notification in JSON format" to study the message structure.

Parameters description:

| Parameter | Description |

|---|---|

| errorCode | Error code (0 in case if message processing is successful) |

| reason | Error description. Set it "OK" if error not occurred |

| responseId | Randomly generated value. Maximum length is 31 character |

10. Error codes

| ERR_CODE | ERR_MSG | Retrying logic for RC |

|---|---|---|

| 0 | Success | Merchant could retry operation |

| 1 | Declined by bank | Merchant could retry operation |

| 2 | Transaction is prohibited by acquiring bank | Merchant could retry operation |

| 3 | Transaction is prohibited by issuing bank | Merchant should update token |

| 4 | Technical/communication problem | Merchant could retry operation. If the error text "Token transferred for payment is blocked in the Portmone.com system", then you need to update the Token |

| 5 | Transaction has exceeded the limit by your bank | Merchant could retry operation |

| 6 | Not sufficient funds | Merchant could retry operation |

| 7 | Invalid CVV or card expiry date | Merchant should update token |

| 8 | Invalid OTP code | n/a |

| 9 | Invalid 3DS data | n/a |

| 10 | Duplicate transactions | Merchant could retry operation |

| 11 | Format error | Merchant could retry operation |

| 12 | Portmone verification | Merchant could retry operation |

| 13 | System error. Please try again. | Merchant could retry operation |

| 14 | Wrong signature | Merchant could retry operation |

| 15 | Query time exceeded | Merchant could retry operation |

| 16 | Invalid request data | Merchant could retry operation |

| 17 | Transaction has exceeded system limits | Customer should contact Portmone.com support. Customer could retry payment |

| 18 | Fraud | Merchant should update token |

| 19 | Order not found | n/a |

| 20 | Transaction declined. Invalid phone number | n/a |

| 21 | An error occurred while accessing the operators billing system to verify the phone number | |

| Repeat the operation later | ||

| 23 | Cancellation (reject operation) failed | Please perform a return (operation return) for the transaction |

Validation error codes

| ERR_CODE | ERR_MSG | Retrying logic for RC |

|---|---|---|

| 511 | Invalid card number | Update card number and retry operation |

| 512 | Invalid bill amount | Update amount and retry operation |

| 513 | Invalid month | Update month value and retry operation |

| 514 | Invalid year | Update year value and retry operation |

| 515 | Invalid CVV2 | Update CVV2 value and retry operation |

| 516 | Decryption error | Update cardData value and retry operation |

11. Test environment

The test mode of the payment gateway means that the Portmone.com system checks the validity of entered data from the Partner's website and its Client, creates an order, but payment card authorization is not performed. The Portmone.com payment gateway may provide the different response (successful or failed), depending on what is necessary for the Partner employees who perform integration.

Please contact our Account Managers for Online Stores to enable and disable test mode

Email: [email protected]

The Portmone.com system provides partners with two test options:

1. Successful payment test

To get a successful response on the Portmone.com default payment page use following payment card details:

Card number: 4444333322221111 Expiry date: Any but not earlier than current day CVV2: Any

2. Failed payment test

To get an error on the Portmone.com default payment page use following payment card details:

Card number: 4111111111111111 Expiry date: Any but not earlier than current day CVV2: Any